Schedule D Instructions 2024

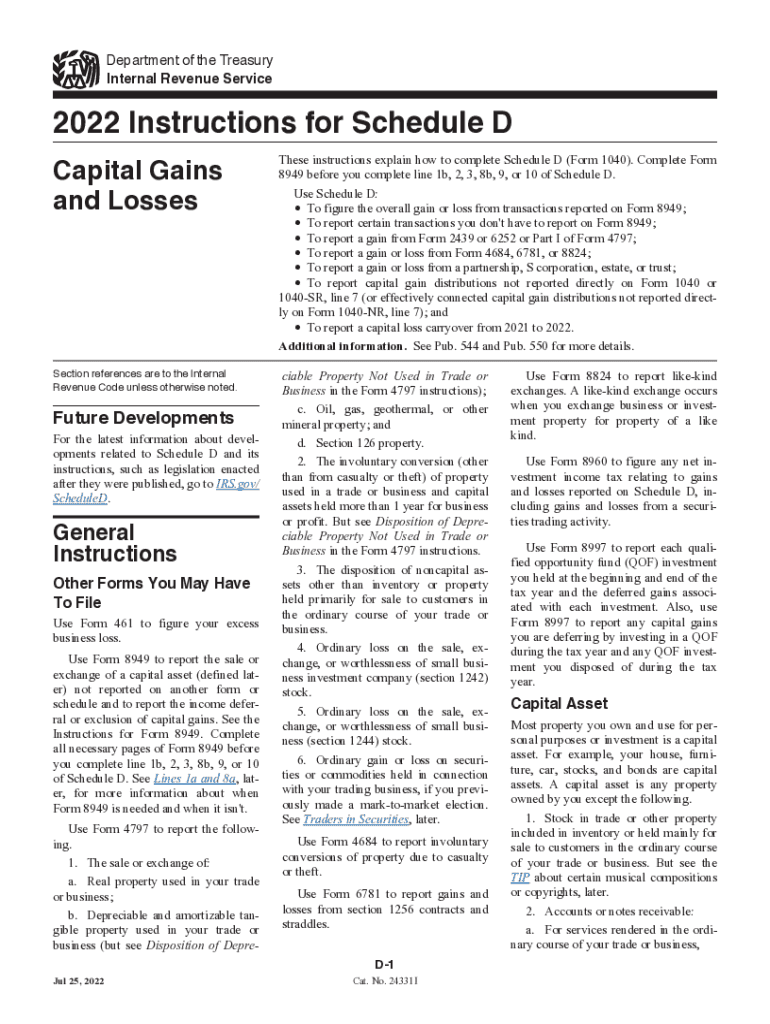

Schedule D Instructions 2024. The overall gain or loss from transactions reported on form 8949, sales and other dispositions of capital assets. Schedule d is the form used to report capital gains and losses from the sale or exchange of capital assets.

See the schedule d instructions for more information. Use schedule d (form 1065) to report the following.

Schedule D Instructions 2024 Images References :

Source: www.dochub.com

Source: www.dochub.com

Capital loss carryover worksheet 2022 Fill out & sign online DocHub, Understanding how to report capital gains and losses on your tax forms is crucial for anyone dealing with investments or asset sales.

Source: wandaqlaetitia.pages.dev

Source: wandaqlaetitia.pages.dev

2024 2024 Tax Form Instructions Delia Fanchon, How to use schedule d in reporting different transactions;

Source: adellaynikkie.pages.dev

Source: adellaynikkie.pages.dev

2024 Tax Forms And Instructions Lari Danyelle, It is used to help you calculate their capital gains or losses, and the amount of.

Source: eppekwkstudyquizz.z13.web.core.windows.net

Source: eppekwkstudyquizz.z13.web.core.windows.net

Capital Gain Worksheet 2024, Instructions to help you claim a research and development (r&d) tax offset in the company tax return 2024.

Source: www.desertcart.co.uk

Source: www.desertcart.co.uk

Buy 2024 ,Desk 20242025,January 2024June 2025, 12×17 in,Desk 202418, How to complete irs schedule d;

Source: juliusrhodes.blogspot.com

Source: juliusrhodes.blogspot.com

2024 calendar free printable calendarkart 2024 yearly calendar with, **determine your gains and losses:

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png) Source: printableformsfree.com

Source: printableformsfree.com

Irs Printable Form Schedule D Printable Forms Free Online, Other frequently asked questions about.

Source: www.form8949.com

Source: www.form8949.com

IRS Schedule D Instructions, To complete schedule d, you'll need to gather the following information:

Source: marthacmorgan.github.io

Source: marthacmorgan.github.io

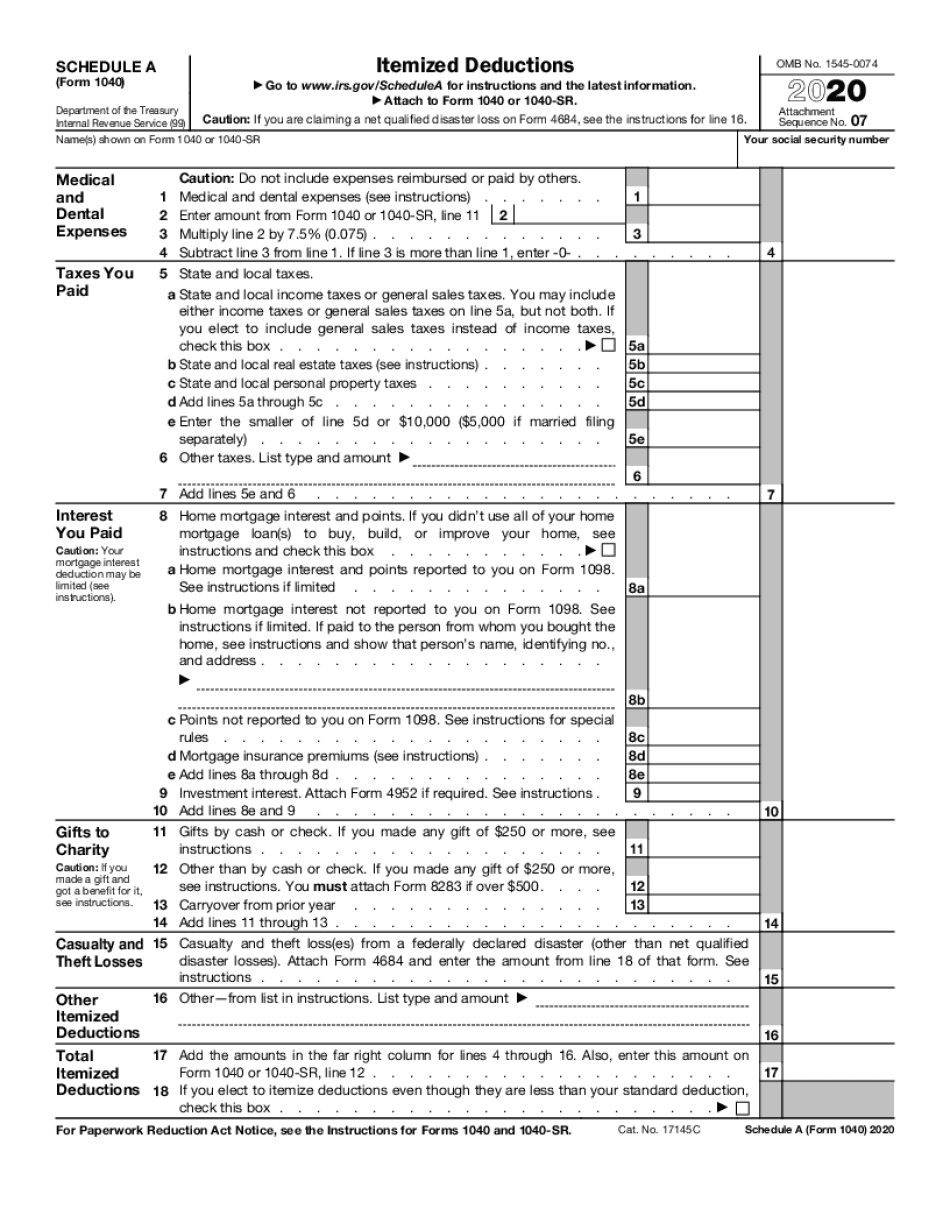

2022 Form 1040 Schedule A Instructions, See the instructions for the schedules later for more information.

Source: form-1040-schedule-a.com

Source: form-1040-schedule-a.com

schedule a instructions 2020 Fill Online, Printable, Fillable Blank, Report these transactions on part i of form 8949 (or line 1a of schedule d if you can use exception 1 under the instructions for line 1,.

Posted in 2024